AAA forecasts that 21.7 million Americans will embark on ocean cruises in 2026, up from an estimated 20.7 million in 2025. The forecast reflects a 4.5 percent increase year-over-year and follows an 8.4 percent rise from 2024 to 2025, extending a four-year streak of record passenger volume.

Passenger Volume and Growth Drivers

Rising Demand and Fleet Expansion

Cruise capacity has expanded in response to growing consumer interest. The deployment of mega-vessels in the Caribbean, Mediterranean and Northern Europe has increased cabin availability. Introduction of shorter, four- to six-night itineraries has also boosted sailings and appealed to travelers with limited vacation time.

Economic and Demographic Factors

Adults aged 55 and older represent 65 percent of U.S. cruise passengers, reflecting strong disposable incomes within this cohort. Those aged 35–54 account for 27 percent, while travelers 18–34 comprise 7 percent. Multigenerational offerings and all-inclusive pricing continue to reinforce cruising’s broad appeal.

Regional Deployment and Seasonality

Caribbean Dominance

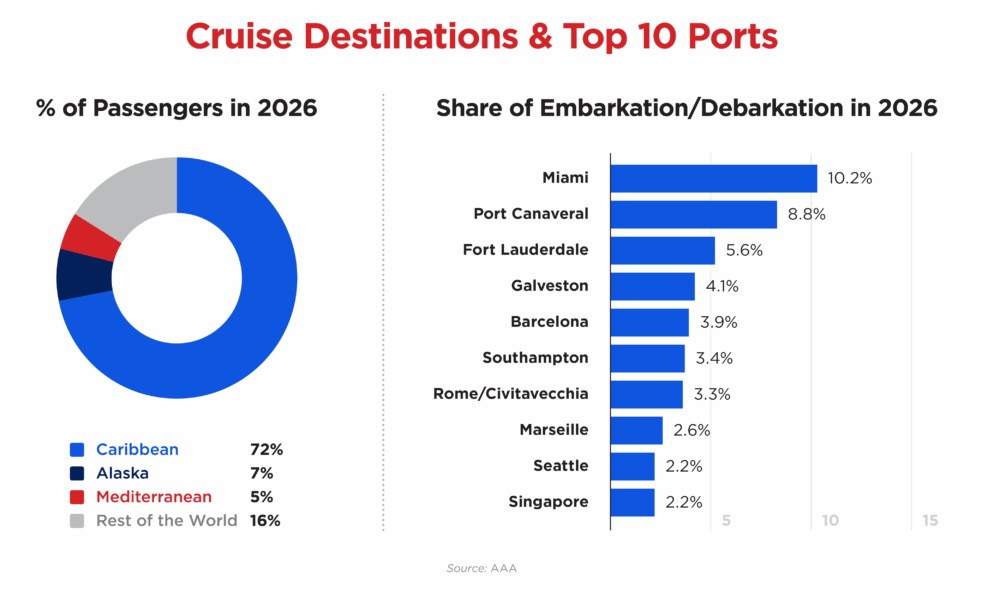

The Caribbean accounts for 72 percent of U.S. cruise embarkations. Miami, Port Canaveral and Fort Lauderdale—among the world’s busiest cruise ports—experience peak activity from November through March. Summer family travel drives higher fares despite a reduced ship count between June and August.

Alaska’s Compressed Season

Alaska cruises run from April through October, concentrating demand into a six-month season and supporting premium pricing. Many passengers combine a summer Alaska voyage with a winter Caribbean cruise to optimize their annual travel plans.

Ship Profiles and Market Segments

Mega-Vessels vs. Smaller Ships

Mega-vessels carrying 4,000 or more guests offer multiple dining venues, entertainment districts and water-park features at scale. In contrast, smaller luxury and expedition ships in Northern Europe and the Mediterranean focus on immersive shore excursions, personalized service and access to remote ports.

Passenger Satisfaction and Loyalty

High Ratings and Repeat Bookings

Ninety percent of U.S. cruise passengers rate their experience as “good” or “very good,” and 91 percent have sailed multiple times. Couples benefit from continuous onboard “date-night” options, families from diverse amenities and solo travelers from dedicated cabins and social programs.

Emerging Expedition Offerings

Cruise lines are expanding expedition itineraries from the Arctic to Antarctica to attract younger and adventure-oriented guests. These voyages combine luxury accommodations with expert-led exploration.

Forecast Methodology

Tourism Economics prepared the 2026 forecast using its proprietary Cruise IP database, scheduled itineraries for major vessels and Oxford Economics’ macroeconomic outlook. The analysis covers departures by U.S. residents from both domestic and international ports.